Yo, so check it – investment risk management is like the key to making that dough, you feel me? This whole deal is all about keeping your money safe and making smart moves in the finance game. So buckle up and get ready to dive into the world of investment risk management!

Now, let’s break it down and get into the nitty-gritty details of why this stuff is so important.

Importance of Investment Risk Management

Investment risk management is like, super important for financial success, dude. It’s all about making sure you don’t lose all your money in one go and protecting your investments from unexpected events.

Poor risk management can totally lead to massive losses, like imagine not diversifying your portfolio and putting all your money in one risky stock. If that stock tanks, you could lose everything in a flash, bro. That’s why having effective risk management strategies in place is key to safeguarding your investments.

Benefits of Effective Risk Management Strategies

Effective risk management can help you minimize losses and maximize returns, dude. By diversifying your investments across different asset classes, you can spread out your risk and reduce the impact of any single investment going south.

Remember, it’s all about balancing risk and reward to achieve your financial goals in the long run.

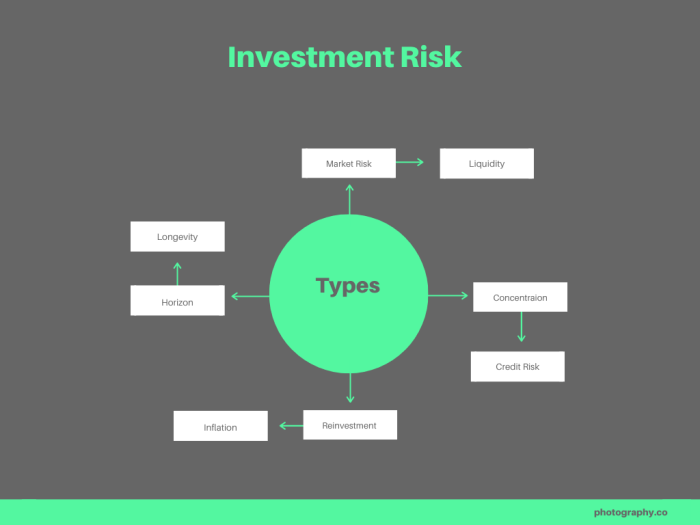

Types of Investment Risks

Investing can be a risky game, and it’s important to understand the different types of risks that can impact your investment portfolio. Let’s dive into the various categories of investment risks and how they can affect your financial future.

Market Risk

Market risk is one of the most common types of investment risks and refers to the possibility of losing money due to changes in the market. This risk is influenced by factors such as economic conditions, geopolitical events, and market volatility. Market risk can impact all types of investments, including stocks, bonds, and mutual funds.

Credit Risk

Credit risk is the risk of loss due to the failure of a borrower to repay a loan or meet their financial obligations. This type of risk is often associated with bonds, especially corporate bonds, where the issuer may default on their payments. Credit risk can lead to losses in a portfolio if the issuer of a bond goes bankrupt or fails to make interest payments.

Liquidity Risk

Liquidity risk refers to the risk of not being able to sell an investment quickly enough without causing a significant loss in value. This risk is more prevalent in assets that are not easily tradable, such as real estate or certain types of bonds. Investors may face liquidity risk if they need to sell an illiquid investment quickly to raise cash.

Interest Rate Risk

Interest rate risk is the risk that changes in interest rates will impact the value of an investment. This risk is particularly relevant to fixed-income securities such as bonds. When interest rates rise, bond prices tend to fall, and vice versa. Investors need to be aware of interest rate risk when building a diversified portfolio.

Inflation Risk

Inflation risk is the risk that the purchasing power of your money will decrease over time due to inflation. Inflation erodes the real value of investments, especially cash and fixed-income securities. Investors need to consider inflation risk when choosing investments to ensure their portfolio can keep up with the rising cost of living.

Strategies for Managing Investment Risks

Investing in the stock market can be a risky business, but there are several strategies you can use to help minimize those risks and protect your hard-earned money.

Diversification

Diversification is the practice of spreading your investments across different asset classes, industries, and geographies. By not putting all your eggs in one basket, you can reduce the impact of a single investment’s poor performance on your overall portfolio. For example, if you only invested in tech stocks and the tech sector experienced a downturn, your entire portfolio would suffer. However, if you diversified by also investing in healthcare and consumer goods stocks, the negative impact would be less severe.

Asset Allocation

Asset allocation involves dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash. Each asset class has different levels of risk and return, so by strategically allocating your investments, you can manage risk while still aiming for growth. For instance, if you’re a young investor with a long time horizon, you may have a higher allocation to stocks for growth potential. As you near retirement, you may shift towards more conservative investments like bonds to protect your capital.

Hedging

Hedging is a strategy used to offset potential losses in one investment by taking an opposite position in another investment. For example, if you’re worried about a decline in the value of a particular stock you own, you could purchase put options to hedge against that risk. If the stock price falls, the value of the put options would increase, offsetting some of the losses in your stock holdings.

Risk Assessment Methods

Investing can be like navigating a maze blindfolded, but risk assessment methods act as your trusty map, guiding you through the twists and turns of the market. By evaluating potential risks before diving in, investors can make more informed decisions and avoid costly mistakes.

Fundamental Analysis

Fundamental analysis is like peeling back the layers of an onion to uncover the true value of an investment. By examining financial statements, economic indicators, and market trends, investors can assess the health and stability of a company before deciding to invest.

- Look at financial statements to assess a company’s revenue, earnings, and debt levels.

- Analyze economic indicators such as GDP growth, interest rates, and inflation to gauge the overall market conditions.

- Consider industry trends and competitive landscape to understand the position of the company within its sector.

Technical Analysis

Technical analysis is all about reading the signs and signals in price charts to predict future market movements. By studying patterns, trends, and indicators, investors can assess the risk and potential rewards of a particular investment.

- Identify support and resistance levels to determine when to buy or sell a stock.

- Use moving averages and oscillators to spot trends and momentum shifts in the market.

- Look for chart patterns like head and shoulders, double tops, and triangles to anticipate price movements.

Scenario Analysis

Scenario analysis is like playing out different scenarios in your head to see how an investment might perform under various conditions. By stress-testing your assumptions and modeling different outcomes, investors can prepare for unexpected events and mitigate potential risks.

- Consider best-case, worst-case, and base-case scenarios to assess the range of potential outcomes.

- Factor in geopolitical events, regulatory changes, or market disruptions that could impact the investment.

- Use sensitivity analysis to quantify the impact of changes in key variables on the investment’s performance.