Yo, get ready to dive into the world of loan amortization schedule! This topic may sound boring at first, but trust me, it’s crucial to understand if you’re dealing with loans. So buckle up and let’s break it down in a way that’s actually interesting.

Now, let’s get into the nitty-gritty of how loan amortization schedules work and why they matter.

What is a loan amortization schedule?

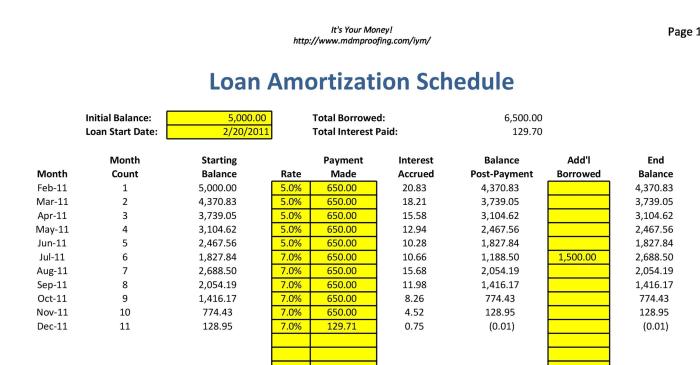

When you take out a loan, it’s important to understand how a loan amortization schedule works. This schedule breaks down each monthly payment into the principal and interest amounts, showing you how much of each payment goes towards paying off the loan balance and how much goes towards interest.

Concept of Loan Amortization Schedule

A loan amortization schedule is a table that details each payment on a loan, showing how much of the payment goes towards the principal balance and how much goes towards interest. As you make payments, the balance decreases, and the interest amount decreases, while the principal amount increases.

Examples of Loan Amortization Schedule

- The first few payments on a loan amortization schedule will have a larger portion going towards interest, with a smaller amount towards the principal.

- As you make more payments, the ratio shifts, and more of each payment goes towards paying off the principal balance.

Components of Loan Amortization Schedule

- Loan Amount: The total amount borrowed.

- Interest Rate: The annual interest rate on the loan.

- Loan Term: The length of time to repay the loan.

- Monthly Payment: The amount due each month.

- Principal Payment: The portion of the monthly payment that goes towards the loan balance.

- Interest Payment: The portion of the monthly payment that goes towards interest.

Importance of Understanding Loan Amortization Schedule

- Helps you see how much you are paying in interest over time.

- Allows you to track how your loan balance decreases with each payment.

- Enables you to understand the total cost of borrowing and make informed financial decisions.

Calculating loan amortization

When it comes to calculating a loan amortization schedule, it’s all about breaking down your loan payments into manageable chunks that cover both the principal amount borrowed and the interest accrued over time. This allows you to see exactly how much you owe at any given point during the life of the loan.

Step-by-step calculation process

To calculate loan amortization, follow these steps:

- Determine the loan amount, interest rate, and loan term.

- Use the loan amortization formula to calculate the monthly payment.

- Break down each payment into principal and interest portions.

- Update the remaining balance after each payment is made.

Loan amortization formula

Monthly Payment = P[r(1+r)^n]/[(1+r)^n-1]

Where:

P = Loan amount

r = Monthly interest rate

n = Total number of payments

Comparison of calculation methods

- Straight-line method: Equal payments are made throughout the loan term, with interest decreasing and principal increasing over time.

- Effective interest rate method: Payments are adjusted based on the remaining loan balance, ensuring that interest is paid off first.

- Rule of 78s method: Interest is front-loaded, meaning more interest is paid in the early stages of the loan.

Understanding loan payments

When it comes to loan payments in an amortization schedule, it’s all about breaking down the total amount borrowed into manageable chunks over time. Each payment consists of two main components: principal and interest.

Principal and Interest Relationship

In a loan payment, the principal is the original amount borrowed, while the interest is the cost of borrowing that money. Initially, a larger portion of each payment goes towards paying off the interest, with the remainder reducing the principal balance. As the loan progresses, the balance shifts, and more of each payment goes towards the principal, gradually decreasing the total amount owed.

Loan Payment Evolution

Over time, the composition of loan payments changes. At the beginning, a larger percentage of each payment is allocated to interest, but as the loan matures, more goes towards reducing the principal. This shift is crucial as it accelerates the process of paying off the loan and decreases the overall interest paid over the loan term.

Impact of Payment Frequency

The frequency of payments also affects the loan amortization schedule. More frequent payments, such as bi-weekly or weekly instead of monthly, can help reduce the total interest paid and shorten the loan term. This is because making more frequent payments reduces the outstanding principal balance faster, resulting in less interest accruing over time.

Managing a loan using an amortization schedule

Managing a loan effectively is crucial to avoid financial stress and pay off debt efficiently. By utilizing an amortization schedule, borrowers can gain insights into their loan repayment plan and take strategic actions to optimize it.

Tips for Paying Off a Loan Faster

- Make bi-weekly payments instead of monthly payments to reduce the overall interest paid over the loan term.

- Round up your monthly payments to the nearest hundred or even thousand to accelerate the payoff process.

- Use windfalls or bonuses to make extra payments towards the principal amount, reducing the total interest paid.

- Consider refinancing your loan to a lower interest rate to save money and pay off the loan quicker.

Understanding Extra Payments

Making extra payments towards the principal balance of the loan can significantly impact the loan term and the total interest paid. By allocating additional funds towards the principal, borrowers can shorten the repayment period and save money on interest costs.

Extra payments directly reduce the outstanding principal balance, leading to a faster payoff and less interest paid over time.

Optimizing a Loan Repayment Plan

- Review your budget regularly to identify areas where you can cut expenses and allocate more funds towards loan payments.

- Monitor the progress of your loan using the amortization schedule to track how extra payments impact the overall repayment timeline.

- Create a repayment strategy based on your financial goals and the information provided by the amortization schedule to stay on track and pay off the loan efficiently.