Dude, diving into the loan application process can be a total maze, right? But fear not! This guide is gonna break it down for you in a way that’s chill and easy to understand. So, buckle up and get ready for the inside scoop on loans!

Alright, so let’s get into the nitty-gritty of what this loan application process is all about.

Overview of Loan Application Process

Yo, so you wanna know how to get that cash flow? Let me break it down for ya. When you’re looking to apply for a loan, there are a few steps you gotta follow to make sure you’re on the right track.

Steps Involved

First things first, you gotta fill out the loan application form. This is where you provide all your personal and financial deets so the lender can check if you’re eligible for that moolah.

- Gather all the necessary documents like ID proof, income statements, and bank statements. You gotta show them the proof, you know?

- Once you’ve submitted your application and documents, the lender will review everything to make a decision. This might take some time, so be patient.

- If your loan gets approved, you’ll receive the terms and conditions. Make sure you read them carefully so you know what you’re getting into.

- Sign on the dotted line if you agree to the terms, and voila! You’ll get that sweet cash in your account.

Documents Required

When you’re applying for a loan, you gotta have your paperwork in order. Here are some common documents you’ll need:

- Valid ID proof like a driver’s license or passport

- Income statements like pay stubs or tax returns

- Bank statements to show your financial history

- Any other documents specific to the type of loan you’re applying for

Importance of Understanding Loan Terms

Before you sign on the dotted line, it’s crucial to understand the terms and conditions of the loan. Here’s why:

- Knowing the interest rate and repayment schedule helps you plan your finances accordingly.

- Understanding any fees or penalties involved can save you from surprises later on.

- If you’re aware of the loan terms, you can avoid any misunderstandings or disputes with the lender.

Types of Loans and Eligibility Criteria

When it comes to loans, there are a few different types you can apply for, each with its own set of eligibility criteria. Let’s break it down for you.

Personal Loans

Personal loans are typically unsecured loans that you can use for various personal expenses like medical bills, home renovations, or debt consolidation. To be eligible for a personal loan, you usually need a good credit score, stable income, and a low debt-to-income ratio. Lenders will also look at your employment history and may require collateral in some cases.

Home Loans

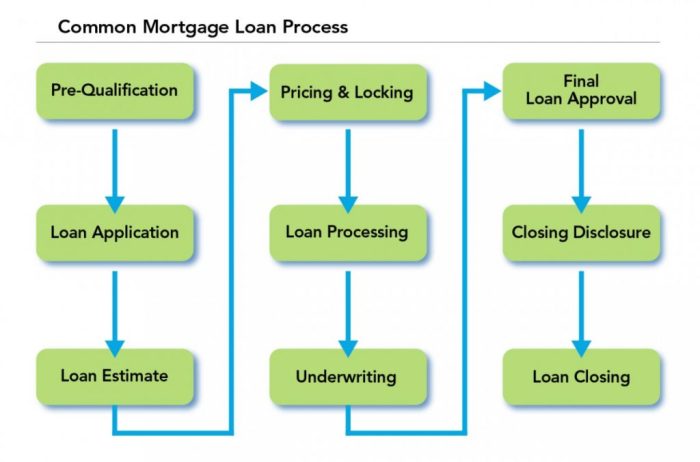

Home loans, also known as mortgages, are specifically for buying a home or refinancing an existing mortgage. Eligibility criteria for home loans include a good credit score, stable income, a low debt-to-income ratio, and a down payment. Lenders will also consider the value of the property you want to buy or refinance, as well as your employment history.

Business Loans

Business loans are designed for entrepreneurs and business owners to fund their business ventures or cover operational expenses. Eligibility criteria for business loans vary depending on the type of loan, but generally include a solid business plan, good credit score, stable revenue, and sometimes collateral. Lenders will also look at the industry you’re in and the financial health of your business.

Preparing for the Loan Application

Before diving into the loan application process, it’s crucial to make sure you’re prepared to increase your chances of approval. Here are some key factors to consider:

Improving Credit Score

Your credit score plays a significant role in determining your loan eligibility and interest rates. To boost your credit score before applying for a loan, consider the following tips:

- Pay your bills on time to show responsible financial behavior.

- Reduce credit card balances to lower your credit utilization ratio.

- Check your credit report for errors and dispute any inaccuracies.

- Avoid opening new lines of credit before applying for a loan.

Significance of Stable Income and Employment History

Lenders look for borrowers with a stable source of income and a consistent employment history to ensure repayment of the loan. Having a stable income and employment history demonstrates your ability to meet financial obligations. Make sure to provide proof of income and employment stability when applying for a loan.

Debt-to-Income Ratio in Loan Approval

Your debt-to-income (DTI) ratio is a crucial factor in the loan approval process. This ratio compares your monthly debt payments to your gross monthly income. Lenders use this metric to assess your ability to manage additional debt. A lower DTI ratio indicates that you have more disposable income to cover loan payments. To improve your DTI ratio, consider paying off existing debts or increasing your income.

Submitting the Loan Application

When it comes to submitting your loan application, it’s crucial to pay attention to details and make sure you provide all the necessary information. This step can greatly impact the approval process and determine whether you get the funds you need.

Filling out the Loan Application Form

- Double-check all personal information such as name, address, contact details, and social security number.

- Provide accurate financial details including income, expenses, assets, and liabilities.

- Be honest about your employment status, job stability, and any other sources of income.

Importance of Submitting Necessary Documents

- Include documents such as pay stubs, bank statements, tax returns, and any other financial records requested by the lender.

- Submitting all required documents along with your application can speed up the approval process and increase your chances of getting approved.

- Missing documents or providing incomplete information can lead to delays or even rejection of your application.

Review and Approval Process

After submitting your loan application, the review and approval process kicks into gear. This is where the lender carefully assesses your application to determine if you qualify for the loan.

Assessing Creditworthiness

- Lenders will look at your credit score to gauge your creditworthiness. A higher credit score indicates that you are more likely to repay the loan on time.

- Your credit history, including any past loans, credit cards, and payment history, will also be considered.

- Your debt-to-income ratio, which shows how much of your monthly income goes towards paying off debts, is another important factor.

Factors Influencing Approval

- Your income and employment status play a significant role in the approval process. Lenders want to ensure that you have a stable source of income to repay the loan.

- The purpose of the loan also matters. Loans for essential needs like housing or education are generally viewed more favorably than loans for luxury items.

- Your existing debts and financial obligations will be considered to determine if you can handle additional debt responsibly.