Buckle up, peeps! We’re diving into the world of loan default consequences. From credit scores taking a hit to legal actions lenders can dish out, we’re spilling all the tea on what happens when you can’t pay up. Get ready for a wild ride!

Now, let’s break it down and see what really goes down when you default on that loan.

Introduction to Loan Default Consequences

When you don’t pay back a loan as agreed upon in the terms and conditions, that’s what we call a loan default. And trust me, it’s not something you want to mess with!

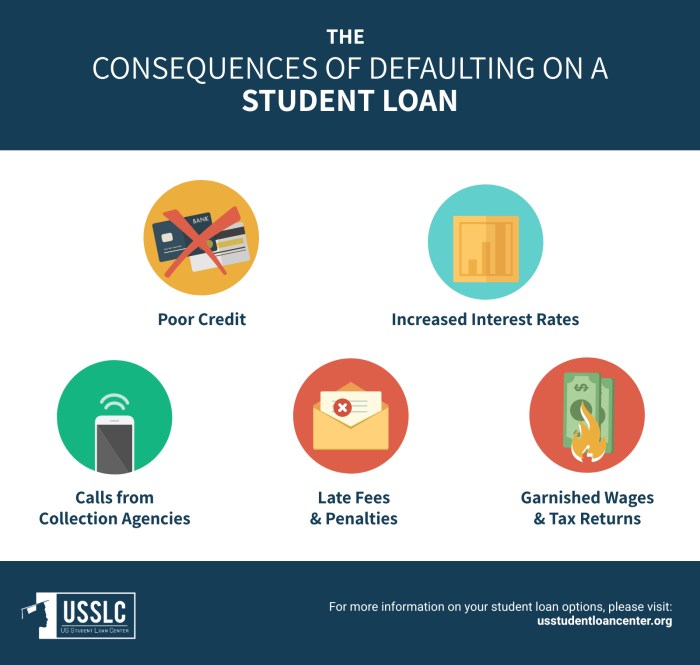

Defaulting on a loan can have some serious implications on your financial situation. Not only will it mess with your credit score, but it can also lead to legal actions being taken against you. It’s a tough situation all around, dude.

Impact of Loan Default on Credit Scores

Let’s talk about how defaulting on a loan can seriously mess up your credit score. Your credit score is like your financial report card, and when you default on a loan, it’s like getting a failing grade. It can take years to repair the damage and get your score back up, so it’s not something to take lightly.

Legal Consequences of Loan Default

When you default on a loan, the lender has the legal right to take actions to recover the amount owed. These legal consequences can have serious implications on your financial situation and credit score.

Actions Taken by Lenders

- Lenders can initiate a lawsuit against you to collect the outstanding debt. If the court rules in their favor, they may be granted a judgment to garnish your wages or seize your assets.

- They can also report the default to credit bureaus, which will negatively impact your credit score and make it harder for you to get approved for future loans or credit cards.

Role of Debt Collection Agencies

Debt collection agencies are often hired by lenders to pursue borrowers who have defaulted on their loans. These agencies use various tactics to recover the debt, including phone calls, letters, and even legal action. They may also add collection fees and interest to the amount owed, making it even more difficult for you to repay.

Implications on Future Loan Applications

- A loan default can stay on your credit report for up to seven years, making it challenging to qualify for new loans or credit cards in the future.

- Lenders may see you as a high-risk borrower and either deny your application or offer you loans with higher interest rates and less favorable terms.

Financial Ramifications of Loan Default

When an individual defaults on a loan, the consequences can be severe, especially when it comes to their financial stability. Not only does it damage their credit score, but it also leads to a chain of financial repercussions that can be difficult to recover from.

Additional Fees and Penalties

Defaulting on a loan often incurs additional fees and penalties, making the debt even more burdensome. Late payment fees, collection charges, and increased interest rates are just some examples of the financial consequences that borrowers may face when they default on a loan.

Asset Seizure

In cases of severe loan default, there is a possibility of asset seizure by the lender. This means that the lender may legally take possession of the borrower’s assets, such as their home or car, to recover the outstanding debt. Asset seizure can have devastating financial implications for the borrower, causing them to lose valuable assets and further impacting their financial stability.

Ways to Avoid Loan Default

To prevent defaulting on loans, individuals should be proactive in managing their finances and communicating with lenders when facing financial difficulties. By taking steps to address financial challenges early on, borrowers can avoid the negative consequences of defaulting on their loans.

Importance of Communication with Lenders

Maintaining open communication with lenders is crucial when experiencing financial hardships. By informing lenders about your situation and discussing possible solutions, such as temporary payment arrangements or loan modifications, borrowers can work towards a mutually beneficial outcome. This proactive approach can help prevent default and preserve the borrower’s credit score.

- Regularly update lenders on financial difficulties

- Explore options for temporary payment arrangements

- Discuss loan modification or restructuring possibilities

Benefits of Loan Modifications or Restructuring

Loan modifications or restructuring can be effective solutions to avoid default. By adjusting the terms of the loan, such as extending the repayment period or reducing the interest rate, borrowers can make their monthly payments more manageable. These changes can help borrowers stay current on their loans and prevent default, ultimately protecting their credit and financial stability.

- Lowering monthly payments through interest rate reduction

- Extending the loan term to reduce the financial burden

- Adjusting repayment schedule to better align with borrower’s financial situation