Loan repayment schedules? Sounds boring, right? Wrong! Get ready to dive into the world of managing your money like a boss with this epic guide that breaks down everything you need to know in a super cool way.

From understanding different types of schedules to calculating those pesky monthly payments, we’ve got you covered with all the deets you need to stay on top of your finances.

Loan Repayment Schedules Overview

Loan repayment schedules are basically plans that Artikel how borrowers will pay back the money they borrowed from a lender. These schedules typically include details such as the amount borrowed, interest rates, repayment periods, and the frequency of payments. Having a structured repayment schedule is crucial for borrowers as it helps them stay on track with their payments, avoid defaulting on the loan, and maintain a good credit history. Different types of loan repayment schedules include fixed repayment schedules, graduated repayment schedules, income-driven repayment schedules, and balloon repayment schedules.

Types of Loan Repayment Schedules

- Fixed Repayment Schedules: In this type of schedule, borrowers make equal payments over a fixed period of time until the loan is fully repaid. This provides predictability and stability for borrowers.

- Graduated Repayment Schedules: With graduated schedules, borrowers start with lower payments that gradually increase over time. This can be beneficial for borrowers who expect their income to increase in the future.

- Income-Driven Repayment Schedules: These schedules adjust the monthly payments based on the borrower’s income, making it more manageable for those with lower incomes.

- Balloon Repayment Schedules: Balloon schedules involve making smaller payments during the loan term with a large final payment due at the end. This can be risky for some borrowers as it requires a lump sum payment at the end.

Components of a Loan Repayment Schedule

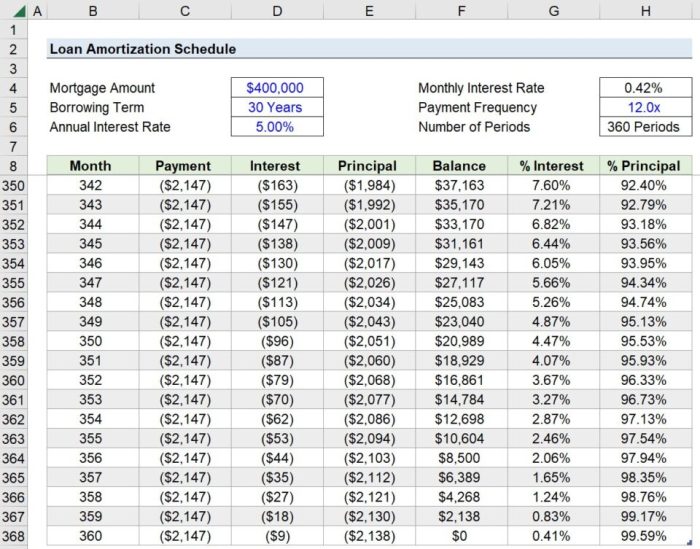

When it comes to loan repayment schedules, there are several key components that borrowers need to be aware of in order to manage their payments effectively. These components include the loan amount, interest rate, term length, and repayment frequency.

Interest Rates in Repayment Schedule

Interest rates play a crucial role in determining the total amount that a borrower will need to repay over the life of the loan. The interest rate is applied to the outstanding balance of the loan, meaning that the higher the interest rate, the more interest the borrower will have to pay. This is why it’s important for borrowers to shop around for the best interest rates before taking out a loan.

Loan Amount and Term Length Impact

The loan amount and term length are also important factors that impact the repayment schedule. A larger loan amount will result in higher monthly payments, while a longer term length will result in lower monthly payments but higher overall interest costs. Borrowers need to find the right balance between the loan amount and term length that fits within their budget and financial goals.

Calculating Loan Repayment Schedules

To calculate loan repayment schedules, mathematical formulas are used to determine the monthly payments. These calculations are essential for borrowers to understand how much they need to pay back and for how long.

Monthly Payment Calculation

When calculating monthly payments for a loan, the formula typically used is the standard loan payment formula. This formula takes into account the principal amount, interest rate, and loan term to determine the fixed monthly payment amount. The formula is as follows:

Monthly Payment = [Principal * (Interest Rate * (1 + Interest Rate)^Loan Term)] / [(1 + Interest Rate)^Loan Term – 1]

Fixed-rate vs. Variable-rate Loans

Fixed-rate loans have a set interest rate that remains constant throughout the loan term. This results in a consistent monthly payment amount until the loan is fully repaid. On the other hand, variable-rate loans have an interest rate that can fluctuate based on market conditions. This can lead to changes in monthly payments, making it harder to predict the total amount to be repaid over time.

Managing Loan Repayment Schedules

When it comes to managing loan repayment schedules, it’s crucial to stay organized and on top of your payments. Here are some tips to help you navigate through the process:

Importance of Timely Payments

- Make sure to set up automatic payments if possible to avoid missing any due dates.

- Keep track of your payment schedule and mark the due dates on a calendar or set reminders on your phone.

- Communicate with your lender if you anticipate any difficulties in making a payment to explore alternative options.

Consequences of Missing Payments

- Missing payments can lead to late fees and a negative impact on your credit score.

- Defaulting on a loan can result in legal action, wage garnishment, or repossession of assets.

- It can also make it harder for you to secure loans or credit in the future.

Strategies for Staying on Track

- Create a budget to ensure you allocate enough funds for your loan payments each month.

- Consider consolidating or refinancing your loans to make repayment more manageable.

- Avoid taking on additional debt while you are still repaying existing loans to prevent financial strain.