Yo, diving into the world of mortgage payment calculators! Get ready to crunch numbers and plan your financial future like a boss. We’ll break down what they’re all about and how they can help you navigate the tricky waters of home loans. Let’s get this money talk started!

So, you wanna know how to use a mortgage payment calculator, huh? Well, we got you covered with the lowdown on everything you need to know.

Introduction to Mortgage Payment Calculator

When you’re diving into the world of adulting and looking to buy a home, you might come across this nifty tool called a mortgage payment calculator. So, what’s the deal with this calculator, you ask? Well, let me break it down for you.

What’s the Scoop?

Alright, so a mortgage payment calculator is basically a tool that helps you figure out how much your monthly mortgage payments will be based on factors like the loan amount, interest rate, and loan term. It’s like a crystal ball that shows you the future of your bank account (kinda).

It’s like having a cheat code for adulting, right? You just plug in some numbers, hit calculate, and boom – you’ll know exactly how much you gotta shell out each month to keep a roof over your head.

Popular Players in the Game

– Zillow: This one-stop-shop for all things real estate offers a user-friendly mortgage payment calculator that even beginners can navigate with ease.

– Bankrate: A trusted name in financial tools, Bankrate’s mortgage calculator lets you play around with different scenarios to see how they affect your monthly payments.

– NerdWallet: Don’t let the name fool you – NerdWallet’s mortgage calculator is anything but nerdy. It’s sleek, simple, and gives you the deets you need without any fuss.

So, next time you’re house hunting and wanna know what your monthly payments might look like, just whip out one of these calculators and let the numbers do the talking. Adulting made easy, am I right?

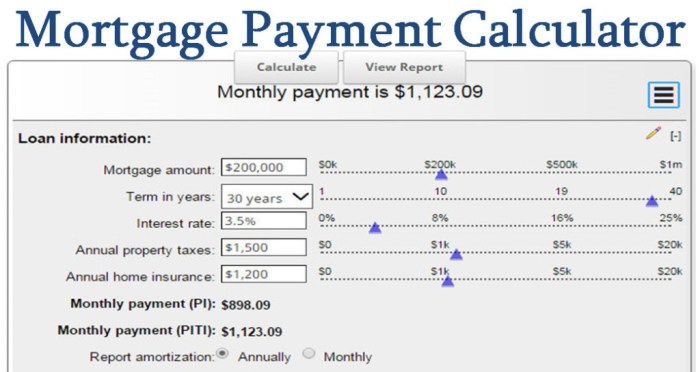

Key Components of a Mortgage Payment Calculator

When using a mortgage payment calculator, there are key components that play a crucial role in determining the monthly payments you’ll need to make. Understanding these components is essential for anyone looking to buy a home or refinance their current mortgage.

Loan Amount

The loan amount is the total amount of money you borrow from a lender to purchase a home. This is a significant factor as it directly influences the size of your monthly payments. The higher the loan amount, the higher your monthly payments will be.

Interest Rate

The interest rate is the percentage of the loan amount that you have to pay the lender for borrowing the money. It’s crucial to pay attention to the interest rate as it greatly impacts the total amount you’ll pay over the life of the loan. A lower interest rate means lower monthly payments and less interest paid over time.

Loan Term

The loan term is the length of time you have to repay the loan. Typically, mortgages have loan terms of 15 or 30 years. The loan term affects your monthly payments, with shorter terms resulting in higher payments but less interest paid overall. Longer terms lower monthly payments but result in more interest paid over time.

Property Taxes and Insurance

In addition to the loan amount, interest rate, and loan term, property taxes and insurance are also important components of a mortgage payment calculator. These costs are typically included in your monthly mortgage payment and can significantly impact the total amount you pay each month.

Impact of Changing Components

Changing any of these components can have a direct impact on the calculated mortgage payment. For example, increasing the loan amount or interest rate will result in higher monthly payments. Conversely, extending the loan term or securing a lower interest rate can lower your monthly payments. Understanding how each component affects your mortgage payment is crucial in making informed decisions about your home purchase or refinance.

Understanding the Results

When you use a mortgage payment calculator, you’ll see a few key values that can help you understand your financial commitment better. Let’s break down what these values mean and how you can use them to your advantage.

Interpreting the Results

- The Monthly Payment: This is the amount you’ll need to pay each month to cover your mortgage. It includes both the principal (the amount you borrowed) and the interest (the cost of borrowing).

- Total Interest Paid: This shows you the total amount of money you’ll pay in interest over the life of the loan. It’s essential to consider this amount when evaluating different loan options.

- Total Cost of the Loan: This value represents the total amount you’ll pay back to the lender, including both the principal and interest. It gives you a clear picture of the overall cost of borrowing.

Analyzing the Results

- Compare Different Scenarios: Use the calculator to compare different loan terms, interest rates, and down payment amounts. This can help you find the most affordable option for your budget.

- Consider the Big Picture: Look beyond just the monthly payment. Take into account the total interest paid and the total cost of the loan to make an informed decision.

- Adjust Your Budget: If the monthly payment is higher than you expected, consider adjusting your budget to ensure you can comfortably afford your mortgage payments.

Common Mistakes to Avoid

- Ignoring Closing Costs: Don’t forget to factor in closing costs when using the mortgage payment calculator. These costs can significantly impact the overall cost of the loan.

- Not Considering Maintenance Costs: Remember that homeownership comes with additional expenses like maintenance and repairs. Make sure you have room in your budget for these costs.

- Overlooking Adjustable-Rate Mortgages: Be cautious when considering adjustable-rate mortgages, as the interest rates can fluctuate over time, potentially increasing your monthly payment.

Advanced Features and Customization Options

To take your mortgage payment calculator game to the next level, let’s dive into some advanced features and customization options that can really make a difference in how you crunch those numbers.

Ever heard of an amortization schedule? It’s like the roadmap to your mortgage payments, showing you exactly how much of each payment goes towards principal and interest over time. Some calculators offer this feature to give you a clearer picture of your financial journey.

Amortization Schedule

- Amortization schedules break down each payment to show the split between interest and principal.

- Users can track how much of the loan they have paid off and how much is left.

- Understanding the amortization schedule can help users make informed decisions about refinancing or making extra payments.

Extra Payments

- Some mortgage payment calculators allow users to input extra payments to see how it affects the overall loan term and interest paid.

- By adding extra payments, users can see how much they can save in interest and pay off their loan faster.

- This feature is great for those looking to accelerate their mortgage payoff timeline.

Customization Options

- Customization options in mortgage payment calculators can include adjusting the loan term, interest rate, and type of loan (fixed-rate vs. adjustable-rate).

- Users can tailor the calculator to their specific financial situation and goals, making it more personalized and accurate.

- Customization options help users see different scenarios and make informed decisions about their mortgage.