Hey there, peeps! So, you’re thinking about diving into the world of investments, huh? Well, buckle up as we explore the exciting realm of real estate vs stocks with all the deets you need to know.

From the nitty-gritty basics to the juicy details, we’ve got you covered on what makes these two investment options unique and how they stack up against each other.

Real Estate vs Stocks

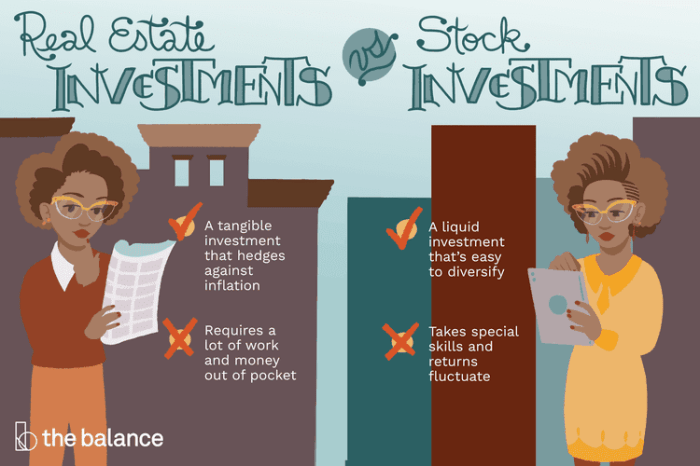

When it comes to investing, two popular options are real estate and stocks. Let’s dive into the basic concepts and principles of each, as well as compare their historical performance as investment choices.

Real Estate Investment Basics

Investing in real estate involves purchasing, owning, managing, renting, or selling properties for profit. This can include residential, commercial, or industrial properties.

Stock Investment Fundamentals

Stock investing is buying shares of ownership in a company. Investors can earn returns through dividends or by selling the shares at a higher price than they paid.

Historical Performance Comparison

Over the years, real estate has been known for its stability and long-term appreciation, while stocks offer greater liquidity and potential for higher returns. Both have their risks and rewards, making them attractive to different types of investors.

Real Estate Investment

Investing in real estate can be a lucrative venture with various types of properties to consider. Let’s explore the different types of real estate investments, the potential benefits, and the associated risks.

Types of Real Estate Investments

- Residential: This includes single-family homes, condos, townhouses, and multi-family properties. Residential real estate can provide steady rental income and potential for property appreciation.

- Commercial: Commercial properties like office buildings, retail spaces, and warehouses offer higher rental yields but may require longer lease terms and higher maintenance costs.

- Industrial: Investing in industrial properties such as manufacturing facilities, distribution centers, and storage units can provide stable long-term returns, especially in growing economies.

Potential Benefits of Investing in Real Estate

- Rental Income: Generating passive income through rent payments from tenants can provide a steady cash flow.

- Property Appreciation: Real estate values tend to increase over time, allowing investors to build equity and potentially sell for a profit.

- Tax Advantages: Investors can benefit from tax deductions on mortgage interest, property taxes, depreciation, and other expenses related to owning real estate.

Risks Associated with Real Estate Investments

- Market Fluctuations: Real estate values can be affected by economic conditions, interest rates, and local market trends, leading to fluctuations in property prices.

- Vacancies: Empty rental properties can result in lost income and additional expenses for maintenance and utilities, impacting the overall profitability of the investment.

- Maintenance Costs: Regular upkeep, repairs, and renovations are necessary to maintain the property’s value and appeal to tenants, adding to the overall cost of ownership.

Stock Market Investment

Investing in the stock market can be a great way to grow your wealth over time, but it’s important to understand the different ways you can invest in stocks, the potential returns, and the risks involved.

Different Ways to Invest in Stocks

- Individual Stocks: Buying shares of a single company allows you to have direct ownership and potential for higher returns, but it also comes with higher risk.

- Mutual Funds: Investing in mutual funds allows you to diversify your investment across multiple companies, reducing risk but potentially limiting returns.

- ETFs (Exchange-Traded Funds): ETFs are similar to mutual funds but trade on the stock exchange like individual stocks, offering diversification and liquidity.

Potential Returns of Investing in Stocks

- Dividends: Some companies pay out a portion of their profits to shareholders in the form of dividends, providing a steady income stream.

- Capital Gains: When the value of your stocks increases, you can sell them for a profit, realizing capital gains.

Risks Involved in Stock Market Investments

- Volatility: Stock prices can fluctuate widely in the short term, making it possible to lose a significant portion of your investment quickly.

- Market Crashes: Sudden drops in the overall market can lead to widespread losses for investors.

- Company-Specific Risks: Individual companies can face challenges such as poor management, legal issues, or industry disruptions that can impact their stock prices.

Real Estate vs Stocks: Risk and Return

When it comes to comparing the risk-return profile of real estate and stocks, several factors come into play. Let’s dive into the details!

- Real Estate:

Investing in real estate typically offers lower volatility compared to stocks. While real estate values can fluctuate, they tend to do so at a slower pace than the stock market. This can provide a more stable return over time, making it a popular choice for investors seeking a lower-risk option.

However, real estate investments may require a significant initial capital outlay, and they are subject to market conditions and property-specific risks.

- Stocks:

Stocks, on the other hand, are known for their higher volatility and potential for significant gains or losses in a short period. This dynamic nature can result in higher returns for investors willing to take on more risk.

Stock market investments can be influenced by a variety of factors, including economic conditions, company performance, and market sentiment.

Liquidity Comparison

When it comes to liquidity, stocks have a clear advantage over real estate investments.

- Stocks:

Stocks can be easily bought and sold on the stock market, providing investors with quick access to their funds. This high level of liquidity allows investors to react swiftly to market changes and capitalize on investment opportunities.

- Real Estate:

Real estate investments, on the other hand, are considered less liquid. Selling a property can take time, and the process may be more complex compared to trading stocks. This lack of liquidity can limit investors’ ability to quickly convert their investment into cash.

Risk Tolerance and Investment Choice

One of the key factors influencing the choice between real estate and stocks is an individual’s risk tolerance.

Risk tolerance refers to an investor’s willingness and ability to endure fluctuations in the value of their investments.

- Low Risk Tolerance:

Investors with a low risk tolerance may prefer real estate for its stability and lower volatility. The slow and steady growth of real estate values can provide a sense of security for those who are risk-averse.

- High Risk Tolerance:

On the other hand, investors with a high risk tolerance may be more inclined towards stocks due to the potential for higher returns. The dynamic nature of the stock market aligns with the risk appetite of those who are comfortable with volatility.