Yo, let’s talk about retirement fund allocation, a key move in the game of financial planning. It’s like setting up your future self for success, so get ready to dive in and level up your money game!

Now, let’s break down the different types of retirement accounts and how to strategize your funds for a secure retirement.

Importance of Retirement Fund Allocation

Yo, let me break it down for you – retirement fund allocation is like the MVP of financial planning. It’s super crucial for securing your future and living your best life when you’re older, you feel me?

Benefits of Strategic Retirement Fund Allocation

When you allocate your retirement funds wisely, you’re setting yourself up for success, my dude. You can enjoy a comfortable lifestyle, travel the world, and basically do whatever your heart desires without stressing about money.

Achieving Retirement Goals with Proper Allocation

Properly allocating your retirement funds can help you reach those goals you’ve been dreaming about since forever. Whether it’s buying a beach house, starting a passion project, or just chilling with your grandkids, strategic allocation is the key, bro.

Types of Retirement Accounts

When it comes to saving for retirement, there are several types of retirement accounts that you can consider. Each type has its own features, benefits, and tax implications. Let’s take a closer look at some of the most common retirement accounts available:

401(k)

- A 401(k) is an employer-sponsored retirement account where you can contribute a portion of your pre-tax income towards your retirement savings.

- One of the key benefits of a 401(k) is that your contributions are typically matched by your employer, which can help your savings grow faster.

- Contributions to a traditional 401(k) are tax-deferred, meaning you don’t pay taxes on the money until you withdraw it during retirement.

IRA (Individual Retirement Account)

- An IRA is a retirement account that you can open on your own, outside of an employer-sponsored plan.

- There are two main types of IRAs: traditional and Roth. In a traditional IRA, your contributions may be tax-deductible, and your investments grow tax-deferred until withdrawal in retirement.

- On the other hand, a Roth IRA offers tax-free withdrawals in retirement, as you contribute after-tax dollars to the account.

Roth IRA

- A Roth IRA is similar to a traditional IRA, but with key differences in how contributions and withdrawals are taxed.

- Contributions to a Roth IRA are made with after-tax dollars, meaning you won’t pay taxes on qualified withdrawals in retirement.

- Roth IRAs also offer more flexibility when it comes to withdrawals, as there are no required minimum distributions (RMDs) during your lifetime.

Strategies for Retirement Fund Allocation

Diversifying your retirement fund investments is crucial to minimize risk and maximize returns. Asset allocation plays a key role in retirement planning by ensuring your portfolio is well-balanced and suited to your goals. Here are some tips for adjusting fund allocation based on age and risk tolerance:

Diversification of Investments

One strategy for retirement fund allocation is to diversify your investments across different asset classes, such as stocks, bonds, and real estate. By spreading your investments, you can reduce the impact of market fluctuations on your overall portfolio.

Importance of Asset Allocation

Asset allocation is essential in retirement planning because it helps you manage risk and achieve your financial goals. By allocating your funds strategically, you can balance growth potential with stability, based on your risk tolerance and time horizon.

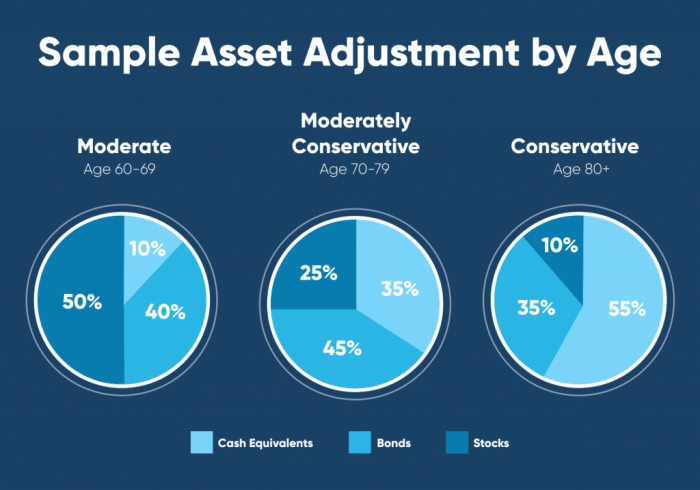

Adjusting Allocation Based on Age and Risk Tolerance

As you get closer to retirement age, it’s important to adjust your fund allocation to reduce risk and preserve capital. Younger investors may have a higher risk tolerance and can afford to take on more aggressive investments, whereas older investors may prioritize capital preservation and income generation.

Risks and Considerations

When it comes to retirement fund allocation, there are several risks and considerations that need to be taken into account to ensure financial security in the future.

Inflation is one of the key factors that can impact retirement fund allocation. As prices of goods and services rise over time, the purchasing power of your retirement savings decreases. This means that if you do not account for inflation when allocating your funds, you may end up with less money than you originally planned for during retirement.

Potential Risks Associated with Retirement Fund Allocation

- Market Volatility: Fluctuations in the stock market can affect the value of your investments.

- Longevity Risk: Outliving your savings due to increased life expectancy.

- Interest Rate Risk: Changes in interest rates can impact the performance of fixed-income investments.

Importance of Periodic Review and Adjustment of Fund Allocation

It is crucial to regularly review and adjust your retirement fund allocation to ensure it aligns with your financial goals and risk tolerance.

- Rebalancing: Adjusting the proportion of assets in your portfolio to maintain desired risk levels.

- Life Changes: Changes in personal circumstances, such as marriage, children, or health, may require adjustments to your fund allocation.

- Market Conditions: Economic changes can impact the performance of different asset classes, necessitating a review of your allocation strategy.