Ready to dive into the world of robo-advisor investing? Get ready to learn all about how these automated tools can help you grow your money without breaking a sweat. Let’s break it down in a way that’s easy to understand, so you can start making some serious cash moves.

Robo-advisor investing is all about using technology to make smart investment decisions without the need for a human financial advisor. Sounds cool, right? Let’s explore how these robots work their magic and why they’re changing the game in the world of investing.

What is Robo-Advisor Investing?

Robo-advisor investing is basically like having a robot do all the heavy lifting for you when it comes to investing your hard-earned cash. These robot financial advisors use fancy algorithms and technology to manage your investments without you having to lift a finger. It’s like having a personal financial advisor, but without the hefty fees.

How Robo-Advisors Work

Robo-advisors work by asking you a bunch of questions about your financial goals, risk tolerance, and investment timeline. Based on your answers, they create a personalized investment portfolio for you made up of low-cost exchange-traded funds (ETFs). Then, they automatically rebalance your portfolio and reinvest dividends to keep you on track towards your goals.

Comparison with Traditional Investment Methods

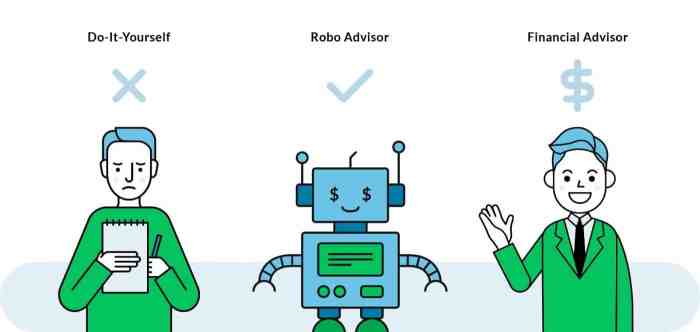

When you compare robo-advisor investing with traditional methods like hiring a human financial advisor or picking stocks on your own, robo-advisors come out on top in terms of cost and convenience. They typically charge lower fees than human advisors and take the emotion out of investing, which can help prevent costly mistakes. Plus, they make investing accessible to everyday people who might not have a ton of money to invest.

Benefits of Robo-Advisor Investing

Robo-advisor investing comes with a range of benefits that can help investors achieve their financial goals more efficiently.

Portfolio Diversification

- Robo-advisors offer automated portfolio management that can help investors diversify their investments across different asset classes, industries, and regions.

- By spreading investments across a variety of assets, investors can reduce risk and potentially increase their returns over time.

- This diversification can help protect a portfolio from the impact of a downturn in any single asset or sector.

Automated Investment Decisions

- Robo-advisors use algorithms and advanced technology to make investment decisions based on an investor’s goals, risk tolerance, and time horizon.

- These automated decisions can help remove emotion from the investment process, reducing the likelihood of making impulsive or irrational investment choices.

- Investors can set up automatic deposits and withdrawals, allowing the robo-advisor to rebalance the portfolio as needed without constant monitoring.

Considerations Before Choosing a Robo-Advisor

When it comes to picking a robo-advisor to handle your investing, there are a few key things you gotta keep in mind. From fees to transparency, these factors can make a big difference in your investment journey.

Fees and Transparency

When you’re looking at different robo-advisor options, one of the most important things to consider is the fees they charge. Some platforms have higher fees than others, so you wanna make sure you’re not paying more than you need to. Transparency is also key – you wanna know exactly what you’re paying for and how it’s gonna affect your returns.

Comparing Robo-Advisor Options

There are tons of robo-advisor options out there, so it can be overwhelming to choose the right one. Take a look at the different features each platform offers, like automatic rebalancing, tax-loss harvesting, and account minimums. You also wanna consider the investment options available and the level of customer support provided. Do your research and find the robo-advisor that best fits your investing style and goals.

Performance and Risks of Robo-Advisor Investing

When it comes to robo-advisor investing, understanding the performance and risks involved is crucial for making informed decisions about your investments.

Robo-advisors typically offer a diversified portfolio of ETFs that aim to match the performance of the market. Historically, these portfolios have shown steady growth over time, providing investors with a convenient way to participate in the market without the need for active management.

Historical Performance of Robo-Advisor Portfolios

- Robo-advisor portfolios have shown consistent growth over the years, with returns closely mirroring the overall market performance.

- By utilizing a passive investment strategy, robo-advisors aim to provide investors with long-term growth potential while minimizing costs and fees.

Potential Risks Associated with Robo-Advisor Investing

- One of the main risks of robo-advisor investing is the lack of personalized advice tailored to individual financial goals and risk tolerance.

- Market fluctuations and economic downturns can also impact the performance of robo-advisor portfolios, potentially leading to losses for investors.

How Robo-Advisors Manage Risk and Optimize Returns

- Robo-advisors use algorithms and modern portfolio theory to create diversified portfolios that aim to optimize returns based on the investor’s risk tolerance and time horizon.

- Automatic rebalancing and tax-loss harvesting are common strategies employed by robo-advisors to manage risk and maximize returns for investors.