So, you’ve graduated and now the time has come to tackle those student loan repayment options. Get ready to dive into the world of paying back those loans with this comprehensive guide that breaks down the nitty-gritty details.

Let’s break it down from the standard repayment plan to income-driven options, loan forgiveness programs, and even refinancing and consolidation. It’s time to take charge of your financial future!

Overview of Student Loan Repayment Options

When it comes to paying back those student loans, you’ve got a few options to choose from. Let’s break it down for you:

Standard Repayment Plan

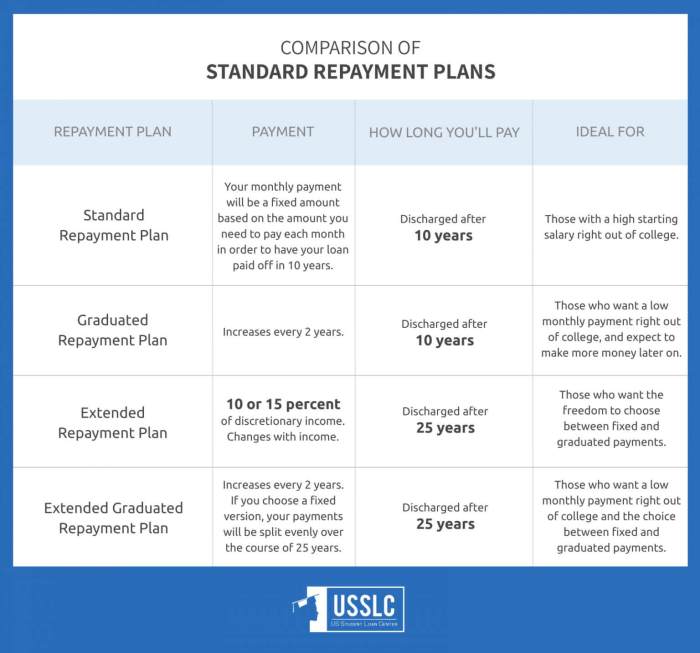

The standard repayment plan is the default option for most federal student loans. You’ll make fixed monthly payments over a period of 10 years. This plan typically results in the lowest overall interest paid, but higher monthly payments.

Income-Driven Repayment Plans

Income-driven repayment plans adjust your monthly payment based on your income and family size. These plans include options like Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). While these plans may result in lower monthly payments, they can extend your repayment period and increase the total interest paid.

Graduated Repayment Plan

Under the graduated repayment plan, your payments start low and increase every two years. This plan is ideal for borrowers expecting their income to rise over time. While your payments may start off lower, keep in mind that you’ll end up paying more in interest over the life of the loan.

Extended Repayment Plan

The extended repayment plan allows you to extend your repayment period beyond the standard 10 years, resulting in lower monthly payments. However, this also means you’ll end up paying more in interest over time.

Remember, each repayment option has its own set of pros and cons. It’s important to weigh your options carefully and choose the plan that works best for your financial situation.

Standard Repayment Plan

The standard repayment plan is a straightforward option for paying off your student loans.

How it Works

Under the standard repayment plan, you make fixed monthly payments over a period of 10 years. This means you’ll have the same monthly payment amount for the entire repayment term.

Fixed Monthly Payments and Repayment Period

The fixed monthly payments are calculated based on the total amount you owe and the 10-year repayment period. This plan ensures that you pay off your loans within a reasonable timeframe without any surprises in your monthly payments.

When to Choose the Standard Repayment Plan

The standard repayment plan is best for borrowers who can afford to make consistent monthly payments over the 10-year period. It is suitable for those who have a stable income and want to pay off their loans quickly without any fluctuations in payment amounts.

Income-Driven Repayment Plans

When it comes to repaying student loans, income-driven repayment plans can be a game-changer for borrowers who may be struggling to make their monthly payments. These plans adjust your monthly payment based on your income and family size, making it more manageable for those with lower income levels.

Income-Based Repayment (IBR)

Income-Based Repayment (IBR) caps your monthly payments at 10-15% of your discretionary income, depending on when you took out your loans. To be eligible, you must demonstrate partial financial hardship, meaning your monthly payment under IBR would be less than what it would be under the standard 10-year repayment plan.

Pay As You Earn (PAYE)

Pay As You Earn (PAYE) also caps your monthly payments at 10% of your discretionary income but is limited to borrowers who took out their first loan after October 1, 2007, and received a disbursement on or after October 1, 2011. To qualify, you must demonstrate partial financial hardship as well.

Revised Pay As You Earn (REPAYE)

Revised Pay As You Earn (REPAYE) also sets your monthly payments at 10% of your discretionary income, but unlike PAYE, there is no eligibility restriction based on when you took out your loans. This plan is available to all Direct Loan borrowers, regardless of when they borrowed.

Income-Contingent Repayment (ICR)

Income-Contingent Repayment (ICR) calculates your monthly payment as the lesser of 20% of your discretionary income or what you would pay on a 12-year standard repayment plan. This plan is available for Direct Loan borrowers and Parent PLUS Loan borrowers who consolidate their loans into a Direct Consolidation Loan.

These income-driven repayment plans provide relief for borrowers with lower income levels by adjusting monthly payments based on what they can afford. It’s important to explore each plan’s eligibility criteria and payment calculations to determine which option works best for your financial situation.

Loan Forgiveness Programs

For students drowning in student loan debt, there is a glimmer of hope in the form of loan forgiveness programs. These programs offer a way out for those who qualify, providing relief from the burden of hefty loan payments.

Public Service Loan Forgiveness (PSLF)

Public Service Loan Forgiveness (PSLF) is a program designed to forgive the remaining balance on Federal Direct Loans after the borrower has made 120 qualifying payments while working full-time for a qualifying employer. Eligible employers include government organizations, non-profit organizations, and other public service organizations. To qualify for PSLF, borrowers must be enrolled in an income-driven repayment plan and meet all other program requirements. It’s important to note that not all repayment plans qualify for PSLF, so borrowers should carefully review the criteria to ensure they are on track for forgiveness.

Teacher Loan Forgiveness

Teacher Loan Forgiveness is another program aimed at providing relief for educators who work in low-income schools or educational service agencies. Eligible teachers can have a portion of their Federal Direct Loans forgiven after completing five consecutive years of service. The amount of forgiveness varies depending on the subject area taught and the level of certification held. Teachers must meet specific requirements to qualify, including teaching in a designated school or subject area, and meeting certain qualifications related to their teaching role.

Implications on Repayment Options

Loan forgiveness programs can have a significant impact on borrowers’ repayment options. For those who qualify and successfully complete the requirements, loan forgiveness can provide a fresh start by eliminating a portion or all of their student loan debt. However, borrowers must carefully follow the guidelines of each program and ensure they meet all eligibility requirements to avoid any potential pitfalls. It’s essential for borrowers to stay informed about the details of these programs and seek guidance from their loan servicer or a financial advisor to maximize their chances of qualifying for loan forgiveness.

Refinancing and Consolidation

When it comes to dealing with student loans, two common options that borrowers often consider are refinancing and consolidation. Both can help simplify repayment, but they work in different ways and have their own pros and cons.

Refinancing

Refinancing involves taking out a new loan from a private lender to pay off your existing student loans. This new loan typically comes with a different interest rate and repayment terms. Here are some benefits and drawbacks to consider:

- Benefits:

- Lower interest rate: Refinancing can potentially lower your interest rate, saving you money over the life of the loan.

- Single monthly payment: By combining multiple loans into one, you only have to worry about one monthly payment.

- Drawbacks:

- Loss of federal loan benefits: If you refinance federal loans into a private loan, you may lose benefits like income-driven repayment plans and loan forgiveness options.

- Eligibility requirements: Not everyone will qualify for a lower interest rate when refinancing, depending on credit score and financial situation.

Consolidation

Consolidation, on the other hand, involves combining multiple federal loans into one new loan with a weighted average interest rate. Here are some key points to keep in mind:

- Benefits:

- Simplified repayment: With consolidation, you only have one monthly payment to manage, making it easier to keep track of your loans.

- Potential lower monthly payment: Consolidation can extend the repayment term, resulting in a lower monthly payment amount.

- Drawbacks:

- Longer repayment term: While a lower monthly payment can be helpful, extending the repayment term may mean paying more in interest over time.

- No interest rate reduction: Unlike refinancing, consolidation does not lower your interest rate, so you may not save money on interest costs.

Tips for Borrowers

If you’re considering refinancing or consolidating your student loans, here are some tips to help you make an informed decision:

- Compare offers: Shop around and compare rates from multiple lenders to find the best deal.

- Consider your financial goals: Think about whether you want to lower your monthly payments, pay off your loans faster, or access different repayment options.

- Understand the terms: Make sure you understand the terms and conditions of the new loan, including any fees, penalties, or changes to repayment options.