Alright, peeps! Let’s dive into the world of credit scores – what they are, why they matter, and how they can impact your financial life. Get ready for a rollercoaster ride filled with all the deets you need to know!

So, buckle up and get ready to explore the ins and outs of credit scores, from how they influence your ability to get a loan to the nitty-gritty details of improving your score.

Importance of Credit Scores

Having a good credit score is crucial when it comes to financial decisions. Your credit score is like a report card that shows how responsible you are with managing your finances. It can impact various aspects of your life, including loan approvals, interest rates, renting a home, leasing a car, and even insurance premiums.

Impact on Loan Approvals and Interest Rates

Your credit score plays a significant role in whether you get approved for a loan or not. Lenders use your credit score to determine your creditworthiness and how risky it is to lend you money. A higher credit score can lead to faster approvals and lower interest rates, saving you money in the long run.

Role in Renting a Home or Leasing a Car

When you’re looking to rent a home or lease a car, landlords and leasing companies often check your credit score to assess your ability to make timely payments. A good credit score can increase your chances of getting approved and may even help you negotiate better rental terms or lower down payments.

Effect on Insurance Premiums

Insurance companies also consider your credit score when calculating your premiums. They use it as a factor to determine your likelihood of filing a claim. A lower credit score may result in higher premiums, as insurers perceive you as a higher risk.

Factors Affecting Credit Scores

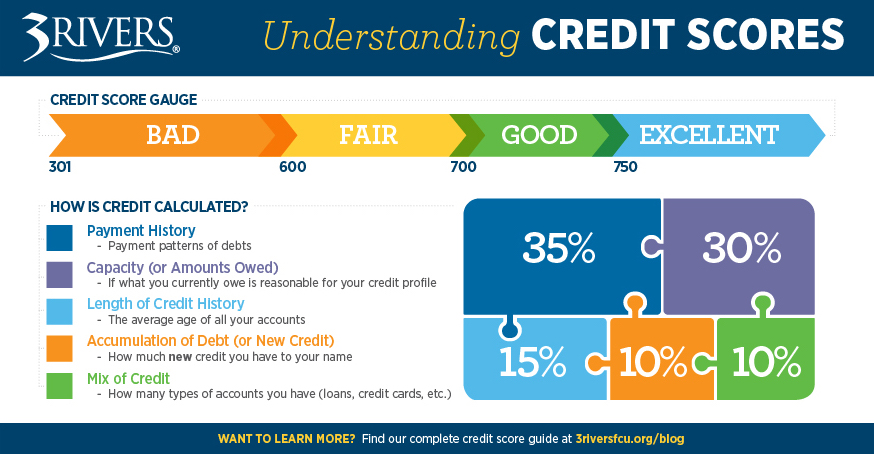

When it comes to credit scores, there are several key factors that play a role in determining your overall score. Understanding these components can help you make informed decisions to improve your creditworthiness.

Payment History:

Your payment history is one of the most significant factors that affect your credit score. Making timely payments on your credit accounts, loans, and bills demonstrates responsible financial behavior and can positively impact your credit score. On the other hand, missing payments or making late payments can lower your score significantly.

Credit Utilization Ratio:

Another crucial factor is your credit utilization ratio, which is the amount of credit you are currently using compared to your total available credit. Keeping this ratio low, ideally below 30%, shows lenders that you are not overly reliant on credit and can manage your finances responsibly.

Other Factors:

In addition to payment history and credit utilization ratio, there are other factors that can influence your credit score positively or negatively. These include the length of your credit history, the types of credit accounts you have, and the number of new credit inquiries on your report.

By understanding these key factors and how they impact your credit score, you can take steps to improve your financial habits and work towards a healthier credit profile.

Understanding Credit Score Ranges

When it comes to credit scores, it’s essential to understand the different ranges and what they mean for your financial health. Each range has its implications and can impact your ability to secure loans, credit cards, or even rent an apartment. Let’s dive into the common credit score ranges and how you can move from one range to another.

Credit Score Ranges

- Poor (300-579): If your credit score falls in this range, lenders may consider you high-risk, making it challenging to qualify for credit or loans. You may face higher interest rates or be required to provide a co-signer.

- Fair (580-669): While you have more options in this range, you may still encounter higher interest rates. It’s crucial to work on improving your score to access better financial opportunities.

- Good (670-739): Falling into this range means you have a solid credit history and are likely to qualify for most loans and credit cards with competitive rates.

- Excellent (740-850): With a credit score in this range, you are considered low-risk by lenders. You can enjoy the best interest rates and offers on financial products.

Average Credit Scores

In the United States, the average credit score hovers around 710, which falls in the good range. However, it’s important to note that credit score averages can vary depending on the region or demographic group.

Tips to Improve Your Credit Score

- Pay your bills on time to establish a positive payment history.

- Keep your credit card balances low and aim to pay them off in full each month.

- Avoid opening multiple new credit accounts in a short period, as it can lower your average account age.

- Regularly check your credit report for errors and dispute any inaccuracies.

- Consider using a credit-building tool like a secured credit card to boost your score gradually.

Improving Credit Scores

To improve credit scores, individuals can follow these strategies and tips to enhance their financial standing and increase their creditworthiness.

Monitoring Credit Reports for Errors

It’s crucial to regularly check credit reports for any errors or inaccuracies that could negatively impact credit scores. By monitoring reports from major credit bureaus like Equifax, Experian, and TransUnion, individuals can quickly identify and dispute any discrepancies to ensure their credit information is correct.

Impact of Closing Old Accounts

Closing old accounts can potentially lower credit scores as it reduces the overall credit available and shortens the length of credit history. It’s important to carefully consider the implications before closing old accounts, especially if they have a positive payment history and contribute to a longer credit age.

Building a Positive Credit History

One effective way to build a positive credit history is by making on-time payments on credit accounts, loans, and bills. Additionally, keeping credit card balances low, avoiding opening multiple new accounts within a short period, and diversifying credit types can all contribute to a strong credit profile. By demonstrating responsible credit management over time, individuals can establish a solid credit history and improve their credit scores.