Alright, peeps, let’s dive into the world of FICO scores and figure out what all the fuss is about. We’re about to break down the nitty-gritty of these scores and how they impact our financial lives. So, buckle up and get ready for a wild ride through the world of credit!

Now, let’s get down to business and unravel the mystery of FICO scores, one step at a time.

Introduction to FICO Scores

FICO scores are three-digit numbers that represent an individual’s creditworthiness based on their credit history. These scores are widely used by lenders to determine the risk of lending money to a borrower.

Importance of FICO Scores

FICO scores play a crucial role in financial matters as they influence the interest rates, loan approvals, and credit limits that individuals can obtain. A higher FICO score indicates a more responsible borrower, leading to better financial opportunities.

Examples of FICO Scores Usage

- Lenders use FICO scores to decide whether to approve a loan application or credit card application.

- Insurance companies may use FICO scores to determine premiums for auto or home insurance policies.

- Landlords might consider FICO scores when reviewing rental applications to evaluate the tenant’s financial reliability.

Components of FICO Scores

Understanding the key components that make up a FICO score is crucial for managing your credit health effectively. Let’s break down the factors that influence your FICO score.

Payment History

Your payment history plays a significant role in determining your FICO score. This component looks at whether you have paid your bills on time, including credit card payments, loan payments, and other debts. Late payments can have a negative impact on your score, so it’s important to always pay on time.

Credit Utilization

Credit utilization refers to the amount of credit you are using compared to the total amount of credit available to you. This ratio is an important factor in calculating your FICO score. Keeping your credit utilization low, ideally below 30%, shows that you are managing your credit responsibly.

Credit Mix and New Credit

Having a mix of different types of credit, such as credit cards, mortgages, and auto loans, can positively impact your FICO score. Additionally, opening new credit accounts can temporarily lower your score due to the credit inquiries and potential increase in overall credit available. It’s important to manage new credit responsibly to avoid negative effects on your score.

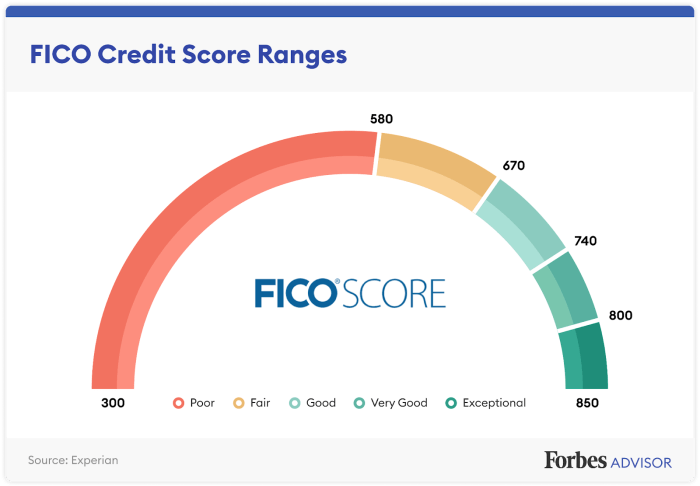

Understanding FICO Score Ranges

When it comes to FICO scores, understanding the score ranges is crucial for managing your credit health. Each range has different implications and can affect your financial opportunities. Let’s dive into the various FICO score ranges and how they impact your creditworthiness.

Poor Credit Score Range

If your FICO score falls below 580, you are considered to have a poor credit score. This can make it challenging to qualify for loans or credit cards, and if you do, you may face higher interest rates. To improve your score in this range, focus on paying your bills on time, reducing credit card balances, and disputing any errors on your credit report.

Fair Credit Score Range

With a FICO score between 580 and 669, you are in the fair credit score range. While you may have more access to credit than those with poor credit, you may still face higher interest rates. To move into a higher range, work on reducing debt, making timely payments, and avoiding new credit applications.

Good Credit Score Range

Falling between 670 and 739, a good credit score opens up more financial opportunities. You may qualify for better interest rates on loans and credit cards. To maintain or improve your score in this range, keep your credit utilization low, avoid closing old accounts, and continue making on-time payments.

Excellent Credit Score Range

An excellent credit score, typically above 740, puts you in the best position for favorable terms on loans and credit cards. You are likely to qualify for the lowest interest rates and best rewards. To stay in this range, keep your credit accounts active, monitor your credit report regularly, and continue practicing smart credit habits.

Factors that Affect FICO Scores

When it comes to your FICO score, there are several key factors that can have a significant impact on your creditworthiness. Understanding these factors is essential for maintaining a good credit score and financial health.

Common Factors that can Negatively Impact FICO Scores

- Payment history: Missing payments or making late payments can lower your FICO score.

- Credit utilization: Using a high percentage of your available credit can negatively affect your score.

- Length of credit history: A shorter credit history may lead to a lower score.

- New credit accounts: Opening multiple new credit accounts in a short period can lower your score.

- Credit mix: Having only one type of credit account may impact your score.

How Inquiries Affect FICO Scores

- Hard inquiries: When you apply for credit, a hard inquiry is made on your credit report, which can temporarily lower your score.

- Soft inquiries: These types of inquiries, like checking your own credit score, do not impact your FICO score.

Role of Derogatory Marks on FICO Scores

- Derogatory marks such as bankruptcies, foreclosures, or collections can have a significant negative impact on your FICO score.

- These marks can stay on your credit report for several years and lower your score.

Tips on How to Maintain a Good FICO Score

- Pay your bills on time and in full to maintain a positive payment history.

- Keep your credit card balances low to improve your credit utilization ratio.

- Avoid opening multiple new credit accounts within a short period.

- Regularly check your credit report for any errors and dispute inaccuracies.

- Monitor your credit score and take steps to improve it over time.

Importance of Monitoring FICO Scores

Regularly checking your FICO scores is super important, dude! It can help you stay on top of your financial game and make sure everything is in order.

Benefits of Monitoring FICO Scores

- Tracking your credit health: By monitoring your FICO scores, you can see how your credit behavior impacts your scores over time.

- Identifying errors: Checking your scores regularly can help you spot any discrepancies or errors on your credit report that could be dragging your scores down.

- Preventing identity theft: Monitoring your FICO scores can help you detect any signs of identity theft early on, so you can take action to protect yourself.

Tools and Resources for Monitoring FICO Scores

- Free credit score websites: Websites like Credit Karma or Credit Sesame offer free credit score monitoring services.

- Credit monitoring services: Companies like Experian, Equifax, and TransUnion provide paid credit monitoring services that offer more comprehensive credit reports and monitoring.

- Mobile apps: There are various apps available that allow you to track your FICO scores on the go, making it super convenient.

How Monitoring FICO Scores Helps Detect Identity Theft or Errors

- Early detection: Regularly monitoring your FICO scores can help you catch any unauthorized activity or errors before they cause serious damage to your credit.

- Alert notifications: Many credit monitoring services send you alerts if there are any significant changes to your credit report, helping you stay informed.

- Peace of mind: Knowing that you are keeping an eye on your FICO scores can give you peace of mind and confidence in your financial well-being.