Yo, ready to dive into the world of venture capital funds? We’re about to break down the nitty-gritty details of how these funds work and why they’re crucial in the financial game. Get ready for a wild ride!

Venture capital funds are like the cool kids on the block, supporting startups and high-growth companies, making dreams come true one investment at a time.

Introduction to Venture Capital Funds

Venture capital funds are investment funds that provide capital to startup companies and small businesses with high growth potential. These funds play a crucial role in the financial market by supporting innovative ideas and businesses that may not have access to traditional sources of funding.

Typical Structure of Venture Capital Funds

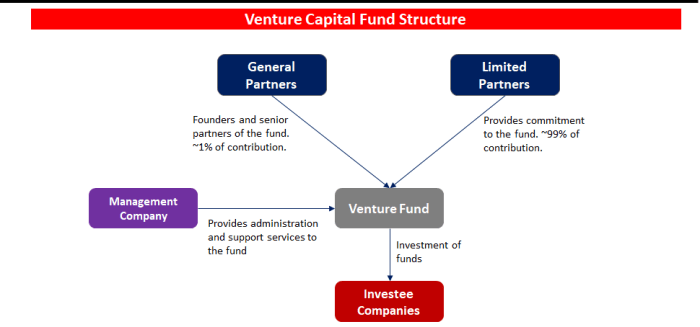

- Venture capital funds are typically structured as limited partnerships, with investors contributing capital to the fund.

- The fund is managed by a general partner who makes investment decisions on behalf of the limited partners.

- Investments are made in exchange for equity in the company, allowing the fund to participate in the success of the business.

Role of Venture Capital Funds in Supporting Startups

- Venture capital funds provide not only financial support but also mentorship and guidance to help startups grow and succeed.

- These funds take on higher risk investments in exchange for the potential of high returns if the startup is successful.

- By supporting startups, venture capital funds contribute to job creation, innovation, and economic growth.

Types of Venture Capital Funds

When it comes to venture capital funds, there are several types that cater to different stages of a company’s growth. Each type has its own characteristics and investment strategies that align with the specific needs of the companies they invest in.

Early-Stage Venture Capital

Early-stage venture capital funds focus on investing in startups that are in the initial stages of development. These funds typically provide capital to help these companies get off the ground and grow. Examples of successful companies funded by early-stage venture capital include Uber, Airbnb, and Snapchat.

Seed Venture Capital

Seed venture capital funds invest in companies at the very beginning of their journey, often providing the first round of funding. These funds take on a higher level of risk but also have the potential for high returns. Companies like Dropbox, Instagram, and Twitch are examples of successful companies funded by seed venture capital.

Growth-Stage Venture Capital

Growth-stage venture capital funds invest in companies that have already established a market presence and are looking to scale up. These funds provide capital to fuel rapid growth and expansion. Successful companies funded by growth-stage venture capital include Pinterest, Spotify, and Slack.

Corporate Venture Capital

Corporate venture capital funds are backed by established companies looking to invest in startups that align with their strategic goals. These funds not only provide capital but also bring industry expertise and resources to the table. Companies like Google Ventures, Intel Capital, and Salesforce Ventures are examples of successful corporate venture capital funds.

How Venture Capital Funds Work

Venture capital funds work by raising money from investors to invest in startups and early-stage companies with high growth potential. These funds typically have a specific focus, such as technology or healthcare, and they provide capital in exchange for equity in the company.

Raising Capital by Venture Capital Funds

When venture capital funds raise capital, they reach out to high-net-worth individuals, institutional investors, and other sources of funding. Investors commit a certain amount of money to the fund, which is then used to make investments in promising startups.

Evaluating Investment Opportunities

Venture capital funds evaluate investment opportunities by conducting thorough due diligence on potential companies. They assess the market opportunity, the strength of the team, the competitive landscape, and the scalability of the business model. If a company meets the fund’s criteria, they will negotiate terms for the investment.

Terms and Conditions of Venture Capital Funding

When venture capital funds invest in a company, they typically receive equity in the form of preferred stock. This gives them certain rights, such as priority in getting paid back in case of a liquidation event. Venture capital funds also often require board seats or observer rights to have a say in the company’s strategic decisions.

Benefits and Risks of Venture Capital Funds

When it comes to venture capital funds, there are both benefits and risks that startups and entrepreneurs need to consider before deciding to pursue this type of funding.

Benefits of Raising Capital from Venture Capital Funds

- Venture capital funds provide access to substantial amounts of capital that can help startups scale and grow quickly.

- Aside from funding, venture capitalists often bring valuable expertise, connections, and guidance to the table, which can be crucial for the success of a young company.

- Unlike traditional loans, venture capital funding does not require immediate repayments, allowing startups to focus on growth without the pressure of debt.

Risks and Challenges Associated with Venture Capital Funding

- Venture capital funding typically involves giving up a portion of ownership and control of the company, which may not align with the vision of the original founders.

- There is a high level of risk involved with venture capital investments, as not all startups succeed, and failure could lead to the loss of the invested capital.

- Startups that receive venture capital funding often face pressure to achieve rapid growth and profitability, which can result in undue stress and unrealistic expectations.

Comparison of Venture Capital Funding with Other Financing Options

- Compared to traditional bank loans, venture capital funding offers more flexibility and support for startups, but at the cost of giving up equity and control.

- Crowdfunding and angel investors provide alternative sources of funding that do not require giving up ownership, but they may not offer the same level of financial backing and expertise as venture capitalists.

- Bootstrapping, or self-funding, allows entrepreneurs to maintain full control over their company, but it may limit the growth potential due to capital constraints.

Trends and Innovations in Venture Capital Funds

In the fast-paced world of venture capital, staying up-to-date with the latest trends and innovations is crucial. Let’s dive into some of the key developments shaping the industry.

Impact Investing

Impact investing has been gaining momentum in the venture capital space. This approach involves investing in companies that not only promise financial returns but also aim to make a positive impact on society and the environment. Impact investors are looking for startups that are dedicated to addressing pressing social or environmental issues while delivering attractive returns.

Diversity Initiatives

Diversity and inclusion have become hot topics in the venture capital world. Many funds are now actively seeking to invest in startups founded by underrepresented minorities, women, and other marginalized groups. By promoting diversity initiatives, venture capital funds are not only supporting a more inclusive ecosystem but also tapping into a broader pool of talent and ideas.

Sector-Specific Funds

Another trend in venture capital is the rise of sector-specific funds. Instead of taking a broad approach, these funds focus on specific industries or technologies, such as healthcare, fintech, or artificial intelligence. By specializing in a particular sector, these funds can offer deeper expertise and better support to startups operating in those areas.

Technology and Data Analytics

Technology and data analytics are revolutionizing the way venture capital funds operate. From using AI algorithms to identify potential investment opportunities to leveraging big data for market research and due diligence, technology is enabling funds to make more informed decisions and drive better outcomes for their portfolio companies.

Global Events Impact

Global events like the COVID-19 pandemic have had a significant impact on venture capital investments and strategies. The uncertainty caused by such events can lead to a temporary slowdown in funding rounds or a shift in focus towards more resilient industries. Venture capital funds are adapting to these changes by exploring new ways to support their portfolio companies and navigate the evolving landscape of the startup ecosystem.